One is considered to be lucky if he can turn his passion into a profession. Starting an online business is an easy way to fulfil that wish. These ventures start small and they are then scaled up slowly. Small businesses often need money. This is especially true in the beginning stages of development. Normally, there are two basic types of funding available to small businesses—debt financing and equity financing. However, we are talking about financing from the ROI of a trading portfolio designed specially to meet the financial needs of this business. In the following paragraphs we will talk about that.

Why do people want to start their own online business?

We want to start our own business. This is sometimes because we want to do something new. Sometimes, we are so tired of our day job and uncertainties of job market that we want to have a second source of income. Starting a business online requires less investment. If you have a hobby and online marketing skills then you can easily do it. Let’s divide a business into four activities: 1) Production 2) Operations, 3) Marketing and 4) Finance. The first three requires skills. However, to run these three activities you need money. Usually, this money either comes from sources outside the business e.g you pay from your salary, take a loan etc or the business income can be ploughed back into the same business. What if I tell you that you can create a portfolio of stocks designed to power your online business?

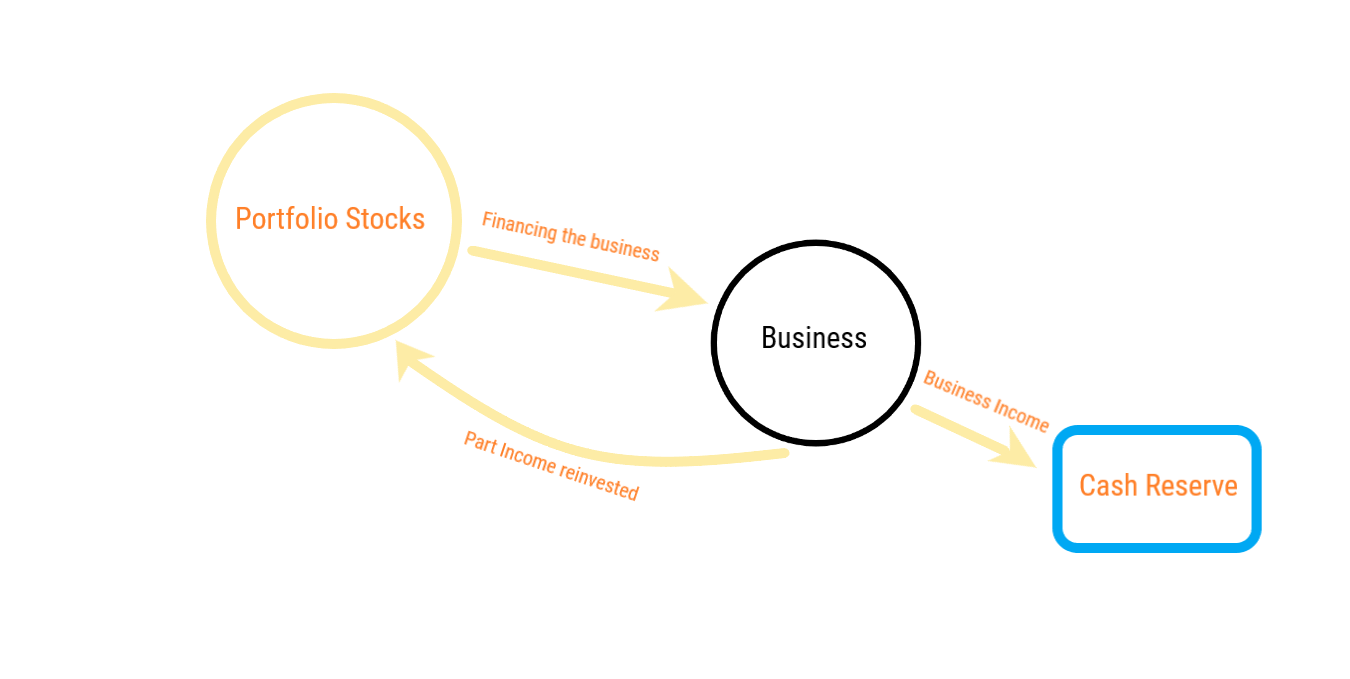

Every investment has a goal. People invest to secure their retirement, pay for their child’s education and so much more. However, today we will talk about long term trading. You will trade in stocks to pay for your business, which in turn will generate income to grow your trading portfolio further. Thus, a money cycle will start and continue for long.

Now a word of caution: Stock trading is subject to market risk. Thus, you cannot say that every time whenever you need money you will get it from your trading profit. During bad market you may have to plough back your business income back to your business, but that’s only sometimes. Trading has a unique advantage. During downtrending market shorting can be a good source of income!

The idea in nutshell:

Establish an online business, generating profits. Set aside half of business profits as a cash reserve. Allocate remaining profits to diversified stock trading, managing risks using tools like stop-loss orders and options. In-depth research informs trading decisions. Reinvest trading gains into the online business for growth. Retain the reserved 50% of business profits to address unforeseen needs or trading losses. This reserve bolsters financial stability. Maintain a balanced emergency fund. Continuously learn and seek professional advice for an adaptable strategy. This comprehensive approach melds online entrepreneurship with stock trading, optimizing profits while safeguarding against uncertainties.

What do you do with the money?

- Pay subscription of the online tools, domains used.

- Pay for the cost of production.

- Pay salaries of virtual assistants if there is any

And so much more….

Let’s pick up an online business plan and see how this model works.

Online business on YouTube

Before starting a business on YouTube, you need to have a business plan. Following are the components of the same.

Content analysis:

Vlog Content: This type of YouTube business features content in the form of a vlog that documents someone’s day-to-day life.

How-To Content: This type of YouTube channel features how-to content, usually structured around a niche such as beauty, kids or home.

Entertainment Content: This type of YouTube channel features comedy skits and other forms of entertainment.

Industry analysis:

- Here you check the following:

- How popular is YouTube in your target market?

- Is the market declining or increasing?

- Who can be your key competitors in the market?

- What trends are affecting the industry?

- Can you get an idea of the industry’s growth forecast over the next 5 – 10 years?

What is the relevant market size? That is, how big is the potential market for your YouTube business? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer analysis

Here you look at the customers you serve and/or expect to serve. Following are some examples of customer segments: adult men, adult women, young men, young women, mothers, teens.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of YouTube business you operate. For example, teens would respond to different marketing promotions than adult men. Further you should drill down to ages, genders, locations and income levels of the customers you seek to serve.

Analysis of competitors

Find out who your competitors are. For each such competitor, make a note of their businesses and document their strengths and weaknesses. Find out key things about them such as:

- What types of viewers do they serve?

- What types of videos do they create, and what topics do they cover?

- What are their strengths?

- What are their weaknesses?

- With regards to the last two questions, think about your answers from the customers’ perspective.

Finally do your own SWOT analysis and document your areas of competitive advantage. For example:

- Will you provide better content, better quality video or delivery?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in your plan.

Marketing Plan

Here you create a plan for your marketing. Based on the types of products or services you will provide your marketing strategy will vary. You can go for social media marketing or paid marketing.

Operations Plan

Here you set your business goals. There are 2 types of goals

- Short term plan – This can show your monthly targets.

- Long term plan – This can be your yearly target.

Financial Plan

Now comes the money part. From where will you get the money to run the entire process mentioned above. As has been mentioned earlier this is where the business driver trading portfolio will play its part in fueling your business.

By now you must have understood how, two very successful business strategies like online business and stock trading have been combined together to boost each other automatically. You just have to weave these two seamlessly and this will double your income opportunity.

Here’s the step-by-step breakdown of the business model, explaining each point as an action point:

1. Start Your Online Business:

– Begin by launching an online business offering products or services aligned with your expertise and market demand.

2. Generate Business Profits:

– Implement effective marketing and sales strategies to generate profits from your online business operations.

3. Allocate 50% as Cash Reserve:

– Reserve 50% of the business profits as a cash reserve, safeguarding against unexpected financial needs or trading losses.

4. Engage in Stock Trading:

– Allocate the remaining 50% of business profits to diversified stock trading activities.

5. Implement Risk Management Tools:

– Use risk management tools such as stop-loss orders and options strategies to mitigate potential trading losses.

6. Conduct Thorough Research:

– Thoroughly research potential trading opportunities, considering historical data, market trends, and company fundamentals.

7. Diversify Trading Portfolio:

– Diversify your trading portfolio by investing in stocks from various industries and sectors.

8. Reinvest Trading Profits:

– Reinvest the profits earned from trading activities back into your online business to fuel growth and expansion.

9. Maintain a Balanced Emergency Fund:

– Maintain a separate emergency fund for your online business to cover unforeseen expenses and ensure financial stability.

10. Continuous Learning and Adaptation:

– Continuously educate yourself about trading strategies, market trends, and risk management techniques.

11. Seek Professional Financial Advice:

– Consult financial advisors with expertise in both trading and business finance for tailored guidance.

12. Adjust Strategies as Needed:

– Be ready to adjust your trading and business strategies based on market changes, performance, and expert advice.

This step-by-step breakdown helps create a clear roadmap for executing the business model while incorporating essential risk management practices and strategic adaptation for sustained success.

N.B: I will be glad if you share your thoughts on this concept on our Facebook page.