Creating a Smallcase portfolio by a layman for building long term wealth. Can I beat the market consistently? That is the subject of this experiment. Here I will show you how I am using the tools available in the market to pick up stocks. It is not necessary that these are real investment made by me. I may or may not have investment in these stocks. Let’s get started!

Have you ever come across a situation where just after you have invested all your money in a stock it started going down? Well, of course you have. How many people on earth are lucky enough to see their investments soaring immediately after investing? This is where the idea of building long term wealth first takes a hit.

My Story

Let me tell you my story. I started trading from 2005. In 2008 when the subprime crisis happened, I took a personal loan of 1 lakh and turned it into 2.15 lakhs in 3 months. After reaching this height the market stopped trending lower and started fluctuating both ways every day. As a result of this I lost 15000/- and stopped trading. I still have doubled my money.

However, by 2010 I found that some of the blue chips which I have traded on the downside in 2008 have gone up by more than 100%. If I deduct the amount of brokerage and short-term capital gains taxes from the profit of 1 lakh in 2008, my returns will be a lot less than what I could have made if I would have simply bought and hold the stocks till 2010. Here I am not even considering the time, energy and stress that I have lost every single day. This is where I missed out on the idea of creating a stategy of building long term wealth by only focusing on the short term. My today’s article is not a stock recommendation where I tell you which stock you should buy. It is to tell you what different I am doing now after learning from 2008 recession to build wealth from stocks.

Today I have decided to do what I did not do in 2008, i.e buy and hold blue chips which are trading at attractive valuations or where I see an upside in future. Now the problem that all of us face quite often is that immediately after buying the stock price falls. Now since I do not have a lot of money, I cannot buy many stocks and keep on averaging on the downside every time the price falls. That is why I had to think of a way of discovering the right stock and identifying the best price. I would like to assure you that you do not have to be a CA or MBA or have any big finance degree to do this. As long as you understand the basics and have read a few books you are good to go. Let me tell you how I am selecting stocks these days.

1st Stage

I watch CNBC TV18, check websites like moneycontrol.com, ET news etc. I read news papers like Economic Times and magazines like Dalal Street. This is where I pick up my initial ideas from.

2nd Stage

Here I do a bit of fundamental checks, where I look at the ROE (preferably > 20%), Debt/equity ratio (preferably 0), and economic moat or competitive advantage. I also like to have a company with reputed management.

ROE = (Net Income/Average shareholder’s equity) x 100

Important:

- Return on equity (ROE) measures how effectively management is using a company’s assets to create profits.

- Whether an ROE is considered satisfactory will depend on what is normal for the industry or company peers.

Debt/Equity ratio = Total Liability/Total Shareholder’s equity

Important:

- This ratio is used to evaluate how much leverage a company is using.

- Higher leverage ratios tend to indicate a company or stock with higher risk to shareholders.

- Investors of consider long term debt only for calculating this ratio as risks for long term debt is different from the short-term payables of the company.

Economic Moat = Competitive advantage

Important:

- Investment decisions should not be based solely on numbers.

- To gain economic moat a company must offer products or services better than its competitors.

- Have a unique product or service.

Other than doing all these I also check if my company is a part of the top performing mutual fund’s top portfolio holdings.

Price-Earning Ratio – What is the PE ratio of the company vis-à-vis the sector. I also look at the current PE vs the 5 years PE range of the stock.

Free cash flow – Free cash flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. The more the cash flow the better it is. Here it is important to check the trend over past 3 years minimum.

SWOT analysis – These days websites like moneycontrol, India Infoline etc gives a SWOT analysis which at a glance gives a snapshot of the strength, weaknesses, opportunities and threats of the company.

3rd Stage

Here I do my technical analysis on charts. This part is very crucial and plays a very important role in deciding the entry point. If this is correct then chances of stock price going down significantly after buying gets substantially nullified. A look at the price action pattern coupled with volume using technical analysis tools help.

Things to check:

- Trend is up.

- Near a support or has given a breakout with volume.

- Positive candle stick pattern

Profit Racing:

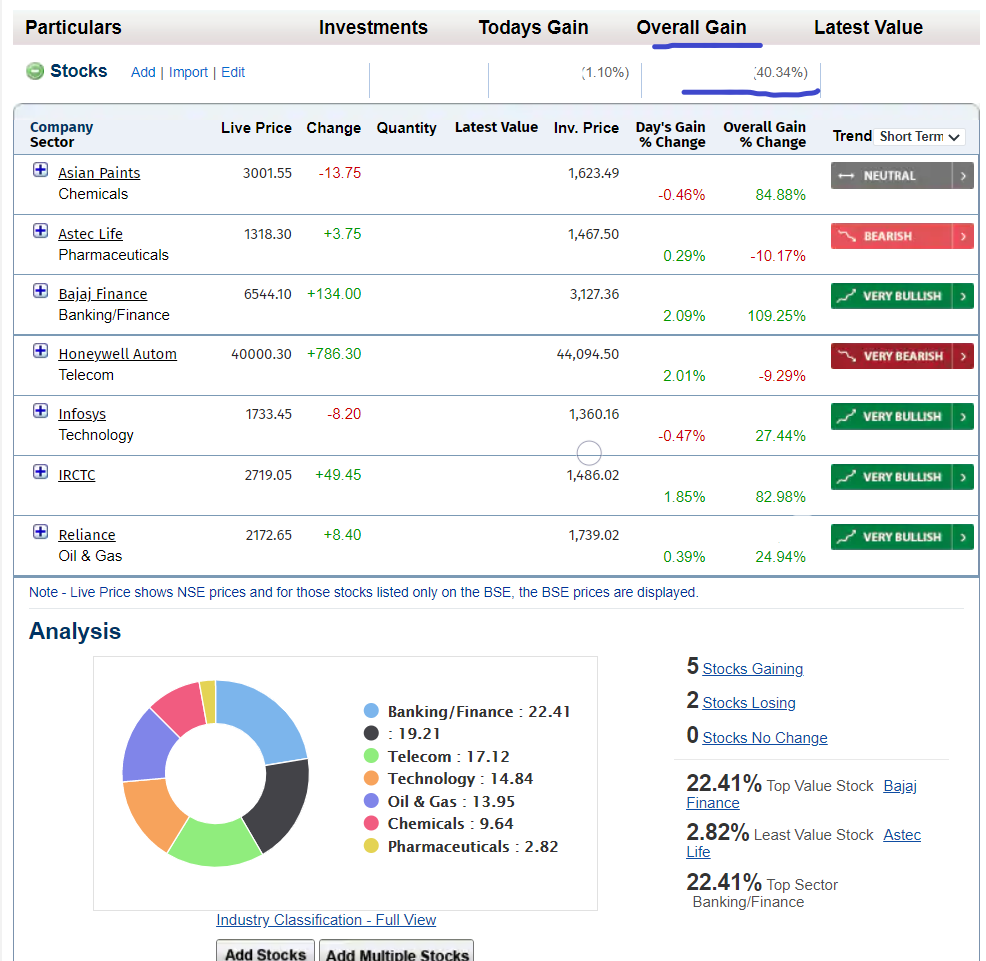

Profit Racing is an experiment where I have created a smallcase portfolio to create long term wealth by beating the market. This portfolio is not created by any professional money manager, but by a layman. I have selected 7 stocks for this experiment. They are:

- Bajaj Finance.

- Reliance

- Infosys

- IRCTC

- ASTEC Life Science.

- Honeywell Automation.

- Asian Paints

I had been creating this portfolio since May 2020. Stocks like Bajaj Finance was bought in May 2020. Whereas Astec and Honeywell were purchased this last July in 2021. As of 20th Aug 2021 the overall gain is 40.34%.

I will be reviewing this portfolio every week. It will be limited to 10 stocks for better focus. Please check my YouTube channel to see if profit is racing or is it falling behind.

Points to remember:

-

Equity investment is the most convenient way of long-term wealth creation.

-

You can get the data of fundamental analysis from websites like Moneycontrol.com, Mint, your broker’s website etc.

-

Do the chart check on monthly, weekly and daily time frame. When all these are showing an uptrend then buy.

-

Most important – Do not try to force a buy or a sell scenario while looking at charts. If it is a buy it should be very apparent. Do not try logical conclusion by adding various components of the chart. A good buy or sell should be visible even to a layman.

-

If you cannot decide whether to buy now, then stay away. Do not blame yourself if later the stock price goes up. Just remember it is your hard-earned money. Investing without being sure is a gamble. Don’t do it. Protect your capital. There are other stocks to invest.

Note: None of the stocks mentioned here or in any part of this experiment should be construed as a recommendation to buy or sell. These stocks are purely based on my own analysis and for educational or experimentation purposes. Please consult a certified financial advisor before taking any financial decision.